The Jacobi solution

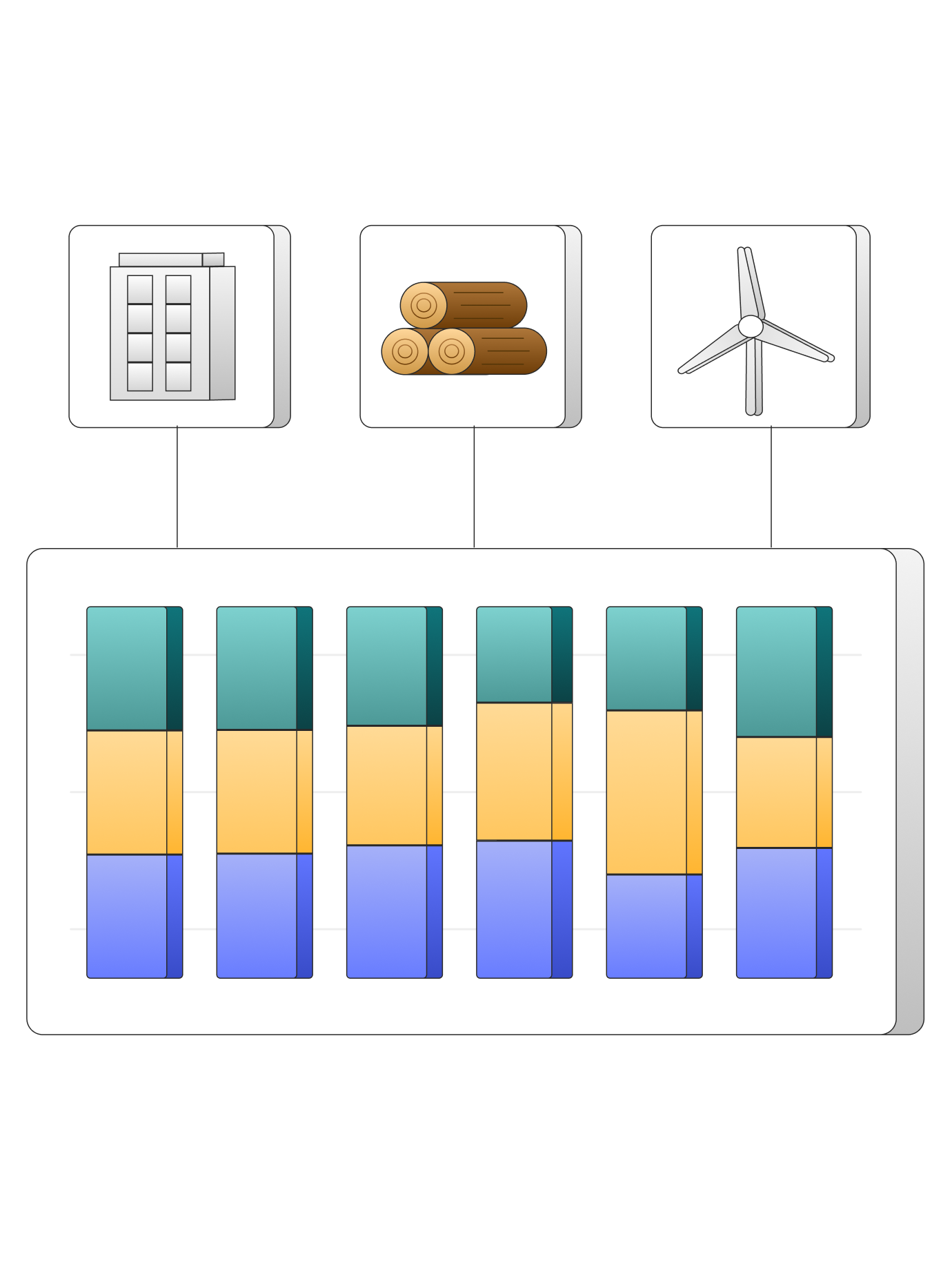

Jacobi’s platform technology supports the design and management of multi-asset portfolios at scale, streamlining investment workflows and enabling dynamic client engagement.

Click on the below to find out more.

Portfolio Builder Application

Retirement Planner Application

Private Assets

Modeling

Multi-Model Portfolio Management

Optimization

Application

Asset Class and Risk Factor Modeling

SAA and DAA Process Management

Client and Board Reporting

Attribution

Asset and Liability Management

Jacobi platform technology

A powerful platform that is built for the multi asset investor

Build portfolios with dynamic modeling and analytics

The Jacobi platform supports the many workflow priorities of the multi-asset investor. Bringing together the front office to end client workflows Jacobi provides an efficient workflow process to generate portfolios aligned to objectives.

Integration of data, and expansion of workflows

Jacobi’s next-gen private cloud infrastructure promotes open architecture and API connectivity. Integrate proprietary investment models, code and data structures that support your distinctive portfolio construction and analytics.

Improve client and stakeholder engagement

The Jacobi report designer provides an intuitive user interface that allows a user to construct a report with the click of a button. Data and analytics are dynamically integrated allowing for fast effective interaction and report generation.

Portfolio builder application

Jacobi’s Portfolio Builder is designed to support the dynamic nature of the portfolio design process. Starting with a current portfolio, a user can make iterative changes as they design a new portfolio or make recommended portfolio changes.

Outcome focussed

Consideration of required portfolio outcomes are supported with robust ex-ante and ex-post analytics and scenario testing.

Seamless communication

Communication is seamless and with the click of a button analytical output can be pushed to organization compliant, white labeled reports.

Retirement planner application

Intuitive integrations

The app allows users to integrate their unique simulations and market assumptions, as well as portfolios.

Data visualization

Intuitive visualizations and analytics helps users understand retirement needs and communicate this with clients.

Private assets modeling

Jacobi’s private asset cash flow modeling toolkit enables multi-asset investors to model investments in private markets and illiquid assets.

Seamless forecasting

Forecast cash flows associated with private asset funds, stress test requirements and use our Commitment Pacing app to solve for the required level of commitments to achieve and maintain a target allocation to private assets.

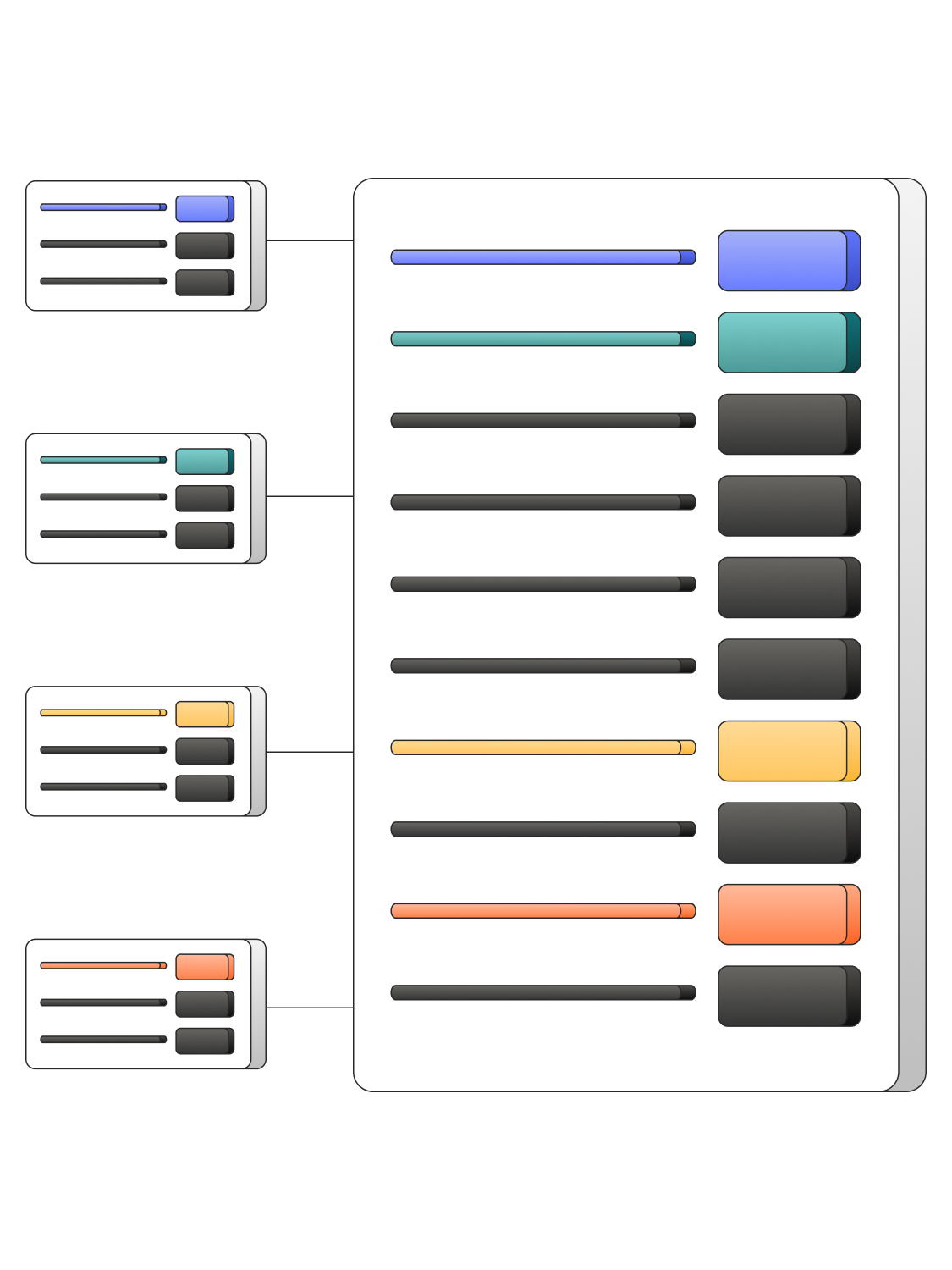

Multi-model portfolio management

Iterative changes

Manage model portfolio workflows, make iterative changes to model groups and then assess impacts of those changes across all linked portfolios.

Governance and compliance

Ensure efficient governance across model changes through configuration and integration of all relevant data and compliance sign off processes.

Optimizer application

Perform portfolio optimizations using a wide range of objective functions and constraints using allocation ranges and customized attributes.

Dynamic integrations

Integrate unique data sets and constraints, bring processes together in dashboards and step-by-step applications and analyze the results across multiple, optimal portfolios.

Interactive storyboards

Share these insights with clients using interactive storyboards

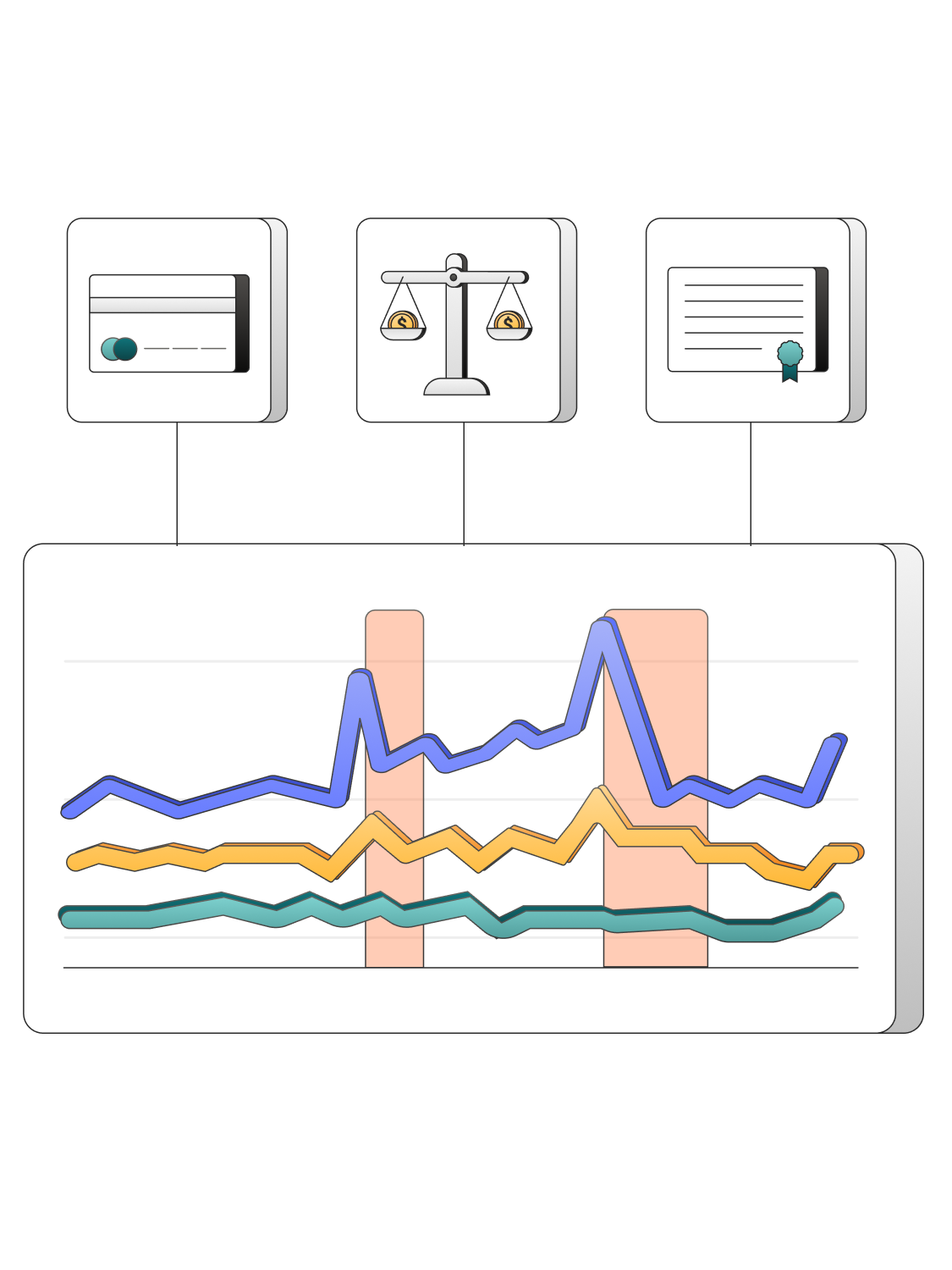

Asset class and risk factor modeling

Jacobi’s risk factor calibration app takes historical data and builds risk factor-based models for various asset classes. Vary the models based on outlooks or changes in positioning, and visualize behavior.

Easily create scenario-based models by selecting periods in history that correspond to particular environments – for instance, high inflation environments or stressed market environments.

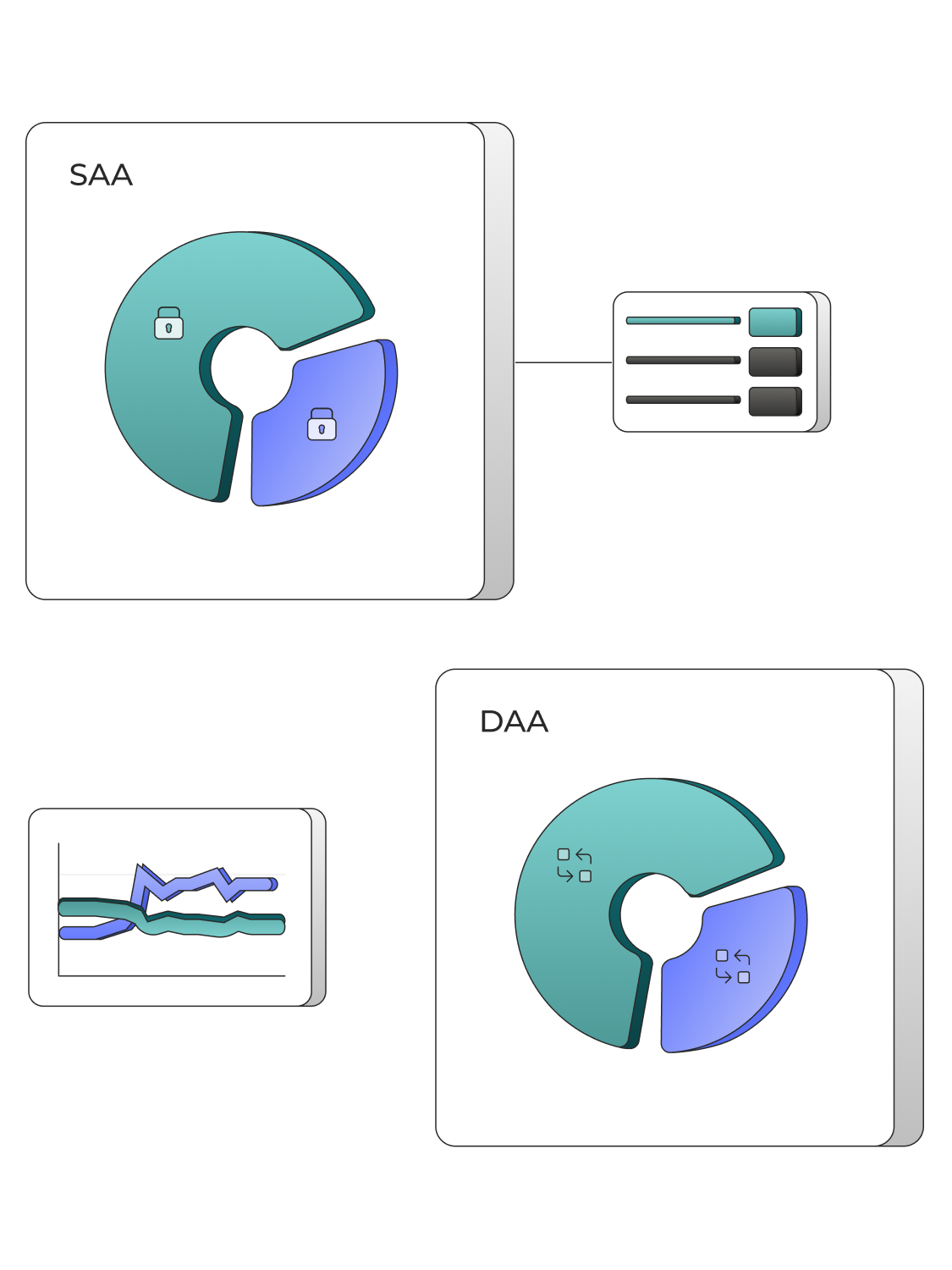

SAA & DAA process management

SAA Decisions

Jacobi’s storyboard technology brings these inputs together in custom dashboards where you define the relevant analytics, and allows you to perform what-if-analysis, compare different possible allocations, and assess portfolios versus benchmarks or peers.

DAA Analysis

You can then incorporate current market views to drive DAA analysis, and see how changing allocations or adding new exposures, changes the overall expected portfolio outcomes, as well as measuring how the DAA positions themselves are expected to perform as a stand-alone long/short portfolio.

Client and board reporting

The Jacobi Report Designer connects your investment and portfolio analytics, charts, and tables into client and board presentations and reports.

Efficient engagement

Ensure efficient and consistent engagement and strengthen relationships.

Crisp visualization

Crisp visualization features, combined with a powerful quantitative engine allows for complex modeling to happen dynamically.

Attribution

Brinson-based multi asset performance attribution – top-down, reflecting the data schema of the client as integrated into the platform. Ability to integrate with custom asset schemas and universes.

Asset and liability management

Analyze both historic and projected funded ratios, changing assumptions on assets or liabilities with ability to introduce tailored metrics.

Analyze volatility and Value at Risk of funding position, change assumption sets and stress test under different market scenarios.

Utilize cash flow analysis, incorporating cash commitments from private assets, applying different assumptions for sponsor commitments.

Introduce unique objectives, constraints and tolerances to incorporate all stakeholder needs, such as funding deficit and drawdown tolerances, sensitivity of sponsor commitment to market variables.

Integrate unique metrics and analytics to enable wider analysis, such as ESG or liquidity scores.

Customize and schedule dashboards for different review and reporting needs.