Asset Owners

Jacobi for Asset Owners

Amplify your investment strategy with Jacobi

Clients and stakeholders increasingly want greater visibility over a firm’s investment strategy but generating a top-down view of both historical and expected risk and return across many pools of capital can be challenging, particularly when managing disconnected systems and processes.

Jacobi’s technology helps multi-asset teams to provide improved visibility and analytics across all pools of capital to ensure alignment of portfolios to objectives and enables effective stakeholder communication across SAA and DAA decisions.

Features

We help some of the world's largest asset owners:

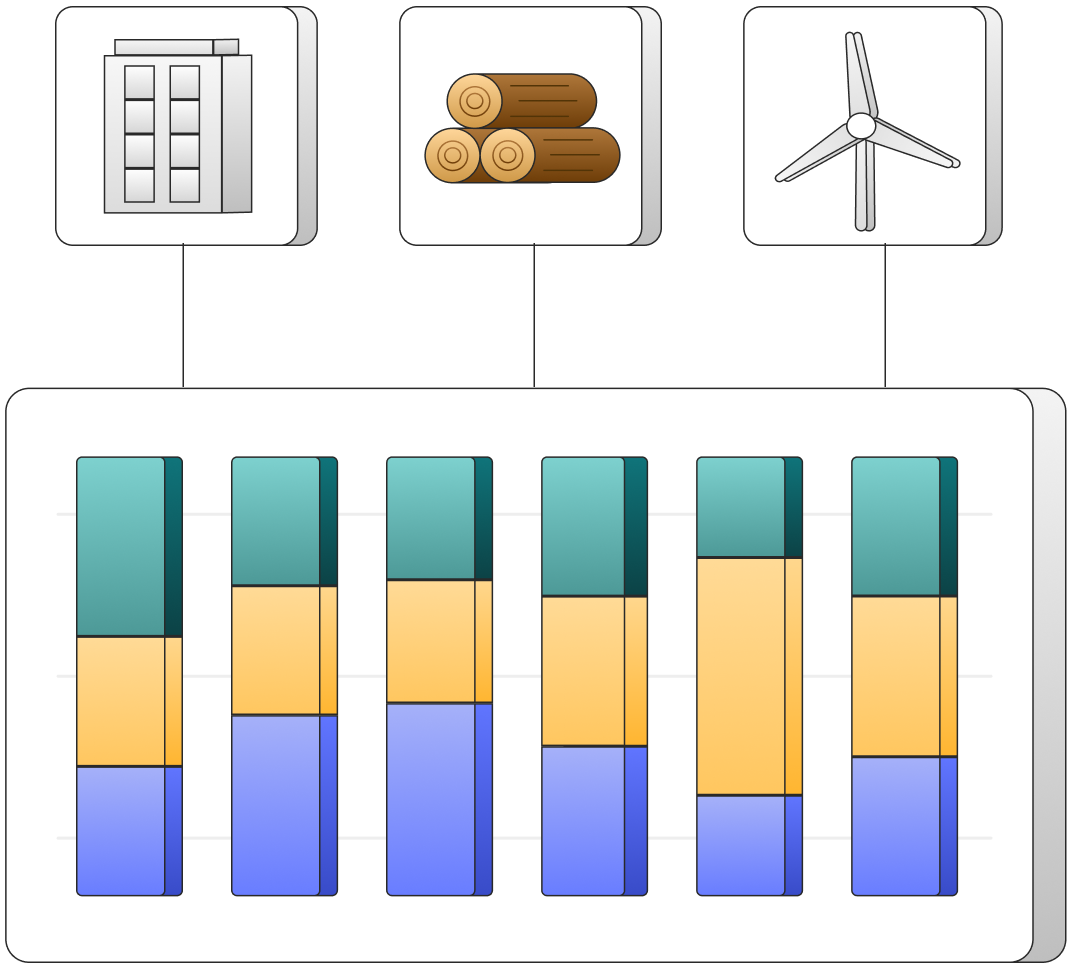

Strategic asset allocation

Strategic asset allocation and Dynamic Asset Allocation tools that incorporate proprietary investment intelligence such as capital market assumptions, risk engines, optimization techniques and data schemas.

Flexibility

Flexibility with the ability to configure solutions to align to each asset owner’s unique investment processes and investment intelligence.

Crisp visualization tools

Crisp visualization tools to communicate decisions to stakeholders.

Real time analytics

Real-time historical and forward-looking portfolio analytics to support investment decision making.

Case study

How Jacobi has helped other Asset Owners

To see how one of Australia’s largest superannuation funds with more than one million members and $40 billion in assets under management used Jacobi to enhance their investment process.