Model Portfolio Management Solution (MPMS)

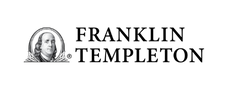

Jacobi’s Model Portfolio Management Solution (MPMS) helps investment teams manage the complete model portfolio lifecycle – from portfolio construction to analytics, governance and client engagement.

Why some of the world's leading investment managers are adopting Jacobi's Model Portfolio Management Solution (MPMS)

Jacobi’s unique Model Portfolio Management Solution (MPMS) helps investment teams design, manage, and scale hundreds of model portfolios effortlessly, offering powerful tools for model customization, analytics, governance and reporting.

As firms build and manage more custom models to meet diverse client needs, they face challenges around scalability, delivery, and governance. Disparate systems create data fragmentation and reliance on manual tools like spreadsheets, hindering efficient model management.

Jacobi’s Model Portfolio Management Solution (MPMS) empowers investment firms to centralize, automate, and manage both off-the-shelf and custom model portfolios at scale. The platform streamlines portfolio design, analytics, and client engagement, while delivering robust governance through configurable approval workflows, enforcing compliance via dynamic rules and constraints, and enabling scalable, automated workflow management for parent-child models.

The Jacobi difference

Explore the benefits of Jacobi's Model Portfolio Management Solution

Features

Benefits

Centralize Model Portfolio Management

Replace disconnected spreadsheets, data and processes with a single streamlined model management capability – increasing efficiency and model revenue.

Automate workflows

Jacobi’s Model Portfolio Management Solution (MPMS) facilitates advanced workflow management, supporting both in-platform and external process chaining, notifications, and user task assignment. It allows you to automate repetitive and manual tasks within the model management lifecycle including data entry, model updates, analytics and reporting – increasing productivity and reduced risk of errors.

Deliver enhanced analytics and modeling

Replace disjointed analytics and risk tools with the centralization of powerful ex-ante and ex-post analytics, asset composition, stress and scenario testing, performance monitoring and portfolio optimization. Unlock deep integrations with external analytics and optimization engines, with formal partnerships and flexible data ingestion pipelines.

Scale Model Portfolio changes across many portfolios

Jacobi enables investment teams to scale and govern change processes across an extensive universe of model portfolios. Teams can cascade changes from ‘parent’ to ‘child’ model portfolios, ensuring strategic and tactical views are uniformly expressed, while adhering to each portfolio’s unique constraints and objectives.

Bring Models to life with clients and stakeholder

Replace tired spreadsheets and Powerpoint presentations with extensive interactive dashboards, reporting and fact sheet design studio. Bring your model portfolios to life – using your brand and replicating your unique reporting requirements.

Improve Model Portfolio governance

The Jacobi MPMS provides robust governance with configurable approval workflows. This enforces compliance through dynamic rules and constraints, and streamlines portfolio updates via scalable, automated workflow management for parent-child models.

For an asset allocation model review, a diagnostic review of an existing suite of models, we've cut our average turnaround time by over 30% by leveraging the Jacobi platform.

T.Rowe Price

Jacobi applications

Power efficient model portfolio management with Jacobi applications

Model Builder Application

Jacobi’s Multi Model Builder simplifies managing model portfolios at scale. With centralized data, users can easily create, review, and collaborate on portfolios. Starting from existing models, they can quickly iterate, adjust allocations, or make security-level changes.

Portfolio Builder Application

Jacobi’s Portfolio Builder streamlines portfolio creation or edits, integrating analytics, reporting, and side-by-side comparisons to assess the impact of portfolio changes.

Portfolio Scaler Application

Jacobi’s Portfolio Scaler automates cascading updates from model parent to child portfolios, applying scaling, risk models, and integrating with trading and compliance.

Explore more Jacobi solutions

Jacobi provides comprehensive, end-to-end solutions designed to support a diverse range of client needs and workflows

Custom Portfolio Solution

Streamline the creation and management of custom portfolio solutions with powerful tools for look-through analysis, risk assessment, and scalable workflow integration.

OCIO Solution

Jacobi’s integrated platform transforms OCIO services by automating portfolio management, deepening risk insights, and providing clear, customizable reporting—helping deliver tailored, scalable investment solutions.

Jacobi Data Engine

Jacobi’s powerful Data Engine unifies and automates investment data, enabling secure, scalable integration and AI-ready analytics across the portfolio lifecycle.

Contact Us

Discover how Jacobi’s Model Portfolio Management Solution (MPMS) can streamline your investment workflows, enhance reporting, and improve decision-making.

Jacobi’s technology has its roots in institutional investment management and brings together investment expertise and a market-leading technology platform. Headquartered in San Francisco, the company is led by a team of experienced investment professionals and engineers.

Offices

San Francisco

44 Montgomery St

San Francisco 94104

United States

London

20 Little Britain

London EC1A 7DH

England

Brisbane

111 Eagle St

Brisbane City 4000

Australia