Jacobi Data Engine

Power your investment workflows with a

data engine built for AI and scale.

Unify, automate, and activate your investment data for scalable, AI-ready multi-asset workflows

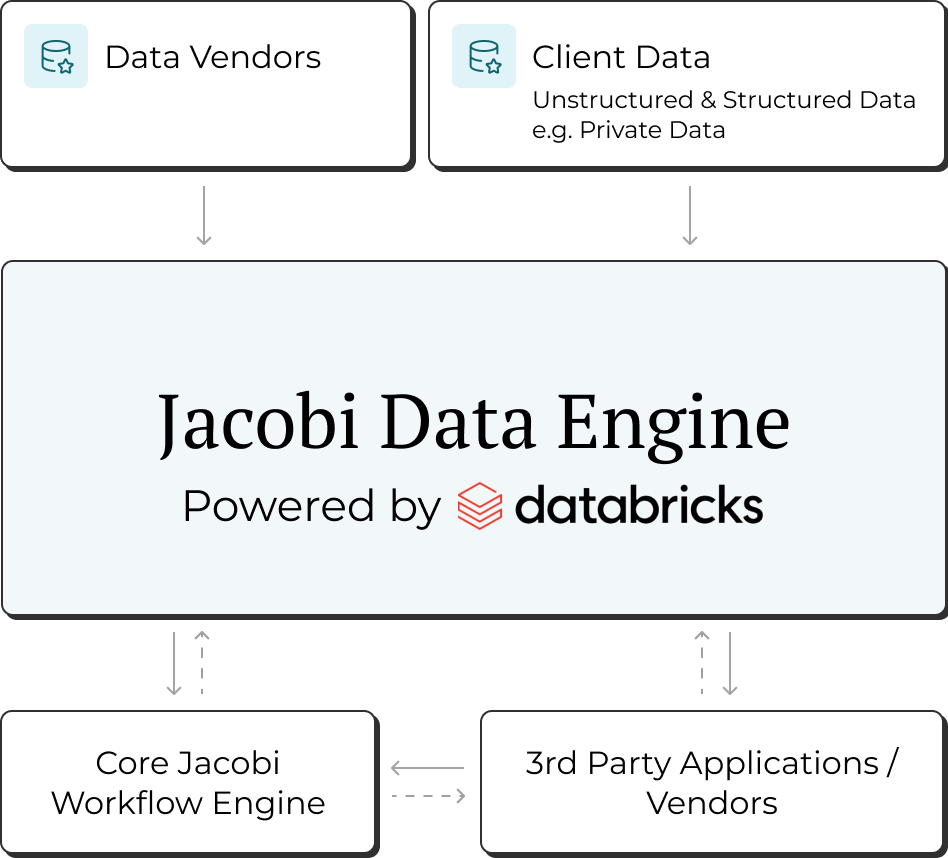

The Jacobi Data Engine transforms the way multi-asset investors harness and connect their data. Engineered to unify fragmented datasets across systems, it provides seamless integration—whether directly within the Jacobi Platform or via external downstream applications.

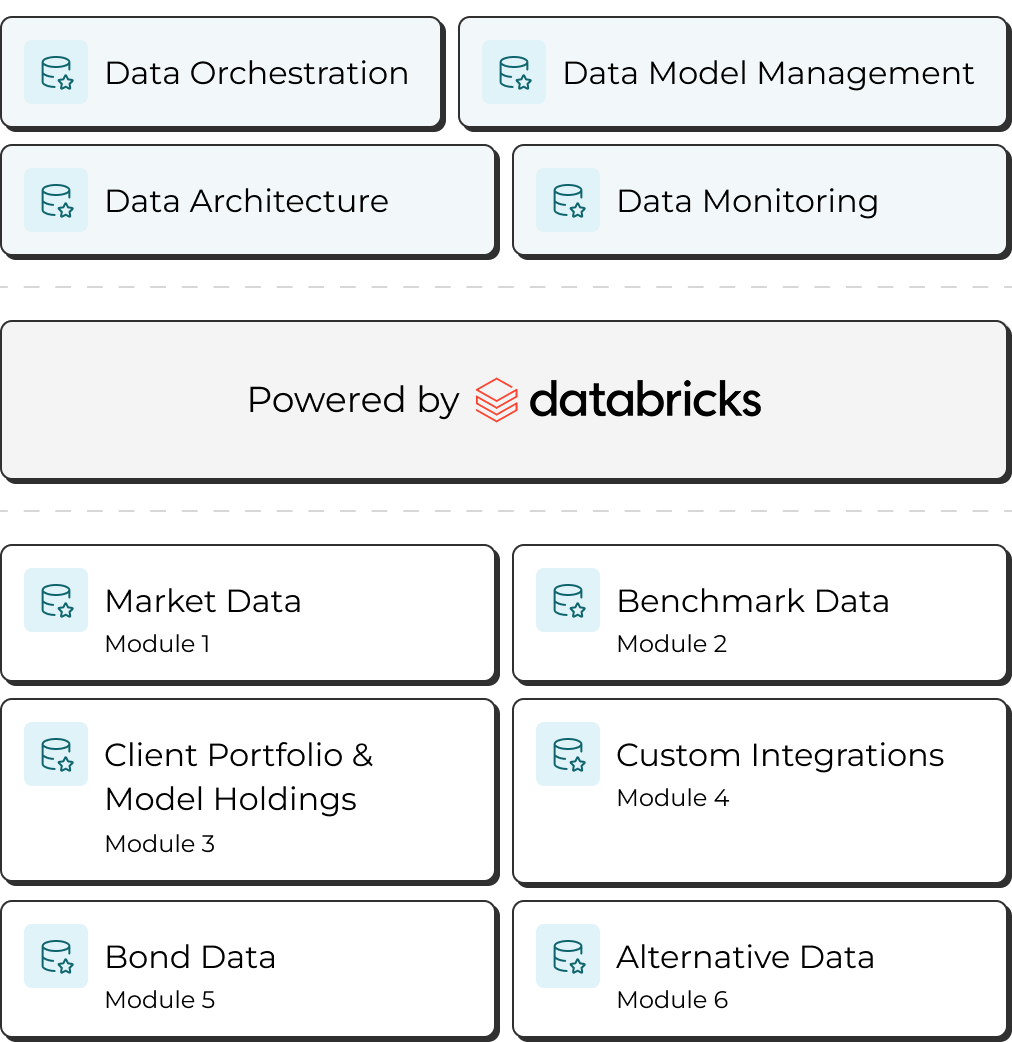

Powered by Databricks, Jacobi’s data infrastructure delivers a powerful, AI-ready ecosystem that automates and orchestrates complex ETL workflows, enforces intelligent data model design, and ensures secure, scalable architecture for seamless data exchange.

With real-time monitoring dashboards and precision QA tools, it empowers investment teams to manage, analyze, and act on data with confidence, speed, and control—transforming data into a strategic asset and laying the foundation for advanced analytics and machine learning across the portfolio lifecycle.

Jacobi’s data engine offers flexible, scalable integration across market, benchmark, and portfolio data. Standard modules support Morningstar fund data and monthly syncs, while enhanced modules enable daily updates, multi-currency transformations, and look-through holdings. Benchmark integrations include S&P, MSCI, Bloomberg, and Cambridge, with support for private and public asset classes.

Jacobi also connects to third-party platforms like Rimes and Refinitiv, and supports custom client data mastering, delivery, and real-time notifications—ensuring your data flows seamlessly into tailored investment workflows.

Key features and benefits

See how seamless data integration can transform your portfolio management

Features

Benefits

Enhanced Data Integrity

Centralize your data to remove duplication and establish a single, trusted source of truth. Standardize schemas and use real-time dashboards for data quality monitoring and alerts.

Take Control With Open Architecture

Take control of your data with open, scalable architecture and interoperable data lakes—eliminating vendor lock-in and enabling long-term flexibility and growth.

Better Governance and Controls

Leverage automated governance tools and modern data architecture to streamline compliance, enforce role-based access, and enable full traceability from original sources to production workflows.

Unlock the AI Opportunity

Modern AI platforms are increasingly designed to work directly with Lakehouse architecture. Unlock AI’s full potential by consolidating governed, unified data within a single, powerful Data Lakehouse.

Jacobi data insights

Why investment groups need a new data strategy for the AI era

As artificial intelligence transforms the investment landscape, traditional data strategies are rapidly losing relevance. For investment groups, the future demands a fundamental shift – from focusing on how data is moved and transformed, to how it is understood and mastered.

Jacobi solutions

Jacobi provides comprehensive, end-to-end solutions designed to support a diverse range of client needs and workflows

Custom Portfolio Solution

Streamline the creation and management of custom portfolio solutions with powerful tools for look-through analysis, risk assessment, and scalable workflow integration.

OCIO Solution

Jacobi’s integrated platform transforms OCIO services by automating portfolio management, deepening risk insights, and providing clear, customizable reporting—helping deliver tailored, scalable investment solutions.

Model Portfolio Management Solution

Jacobi helps investment teams design, manage, and scale many model portfolios effortlessly—leveraging powerful tools for optimization, analytics, and reporting.

Contact Us

Discover how Jacobi’s AI-ready platform can streamline your workflows, enhance data governance, and unlock new insights.

Jacobi’s technology has its roots in institutional investment management and brings together investment expertise and a market-leading technology platform. Headquartered in San Francisco, the company is led by a team of experienced investment professionals and engineers.

Offices

San Francisco

44 Montgomery St

San Francisco 94104

United States

London

20 Little Britain

London EC1A 7DH

England

Brisbane

111 Eagle St

Brisbane City 4000

Australia